NFO or the New Fund Offer is offered by firms (AMCs) when launching a new fund as the first-time subscription offer. The funds are generally launched to raise capital for financing the purchase of securities, shares, etc.

How is an NFO different from other fund subscriptions?

At an NFO, the fund is offered at a very nominal offer price, mostly fixed at Rs. 10. After the NFO, if you are looking to subscribe to the fund, you have to pay the actual price. It is to be noted that most of the time, the investors who invest during an NFO stand to gain more than the investors who come to the party later. The NFO runs for a very limited period and is quite a lucrative investment opportunity for investors.

Know about HDFC MSCI World Index NFO

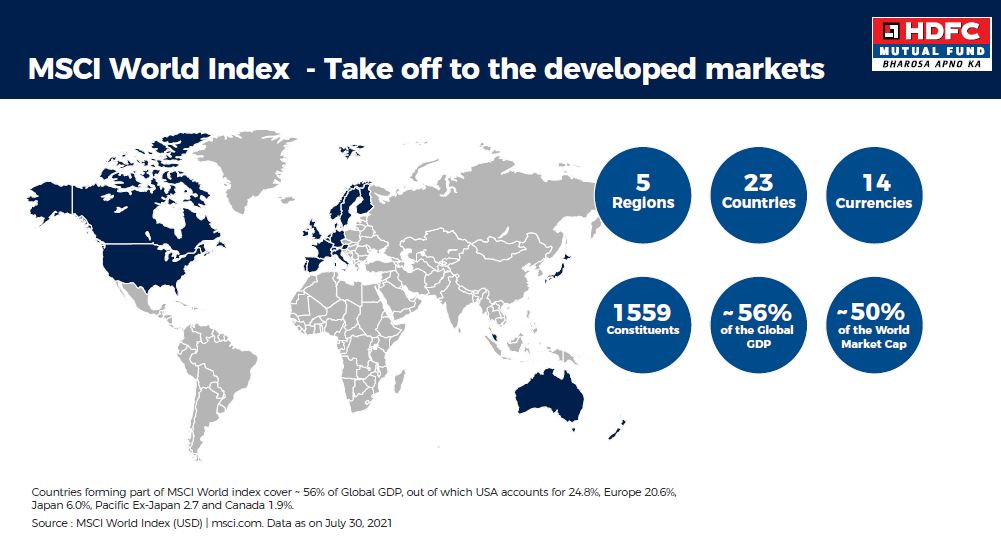

Index funds are normally those which are invested into stocks after factoring in their liquidity and stock size. The HDFC Index fund is quite similar to the mutual funds, in terms of investment into diversified overseas index funds, to give you a balanced portfolio. The MSCI World Index has representation on the mid and large-cap markets spread across 23 different emerging/developed economies and has about 1500 constitutes in one fund.

The asset allocation of this NFO is proposed to have more than 95% in overseas ETFs/index funds with remaining invested in the debt funds. The ETFs and/or the index funds chosen for investment under this scheme are managed by Credit Suisse, a prominent AMC in the field.

Why would this NFO be beneficial to you?

It is common knowledge that diversifying your investments will grant greater stability to your portfolio. If you are looking at long-term benefits, then investing in developed and emerging markets, across diverse sectors, will grant you better returns.

The HDFC DEVELOPED WORLD INDEXES FUND OF FUNDS guarantees to protect you from a volatile portfolio with their clear-cut asset allocation and still offers you returns as good as other equity instruments in the country.

- Investment into developed markets guarantees stability in returns, transparency in policy guidelines, well-defined dividends, and a friendly environment for shareholders in general. There are quite a few mature companies in countries like Canada, the US, and Europe offering you the perfect opportunity for a fruitful steady investment. It is also noted that the developed markets are where the index funds perform better than other mutual funds making HDFC MSCI World Index FOF NFO, the perfect opportunity for guaranteed returns.

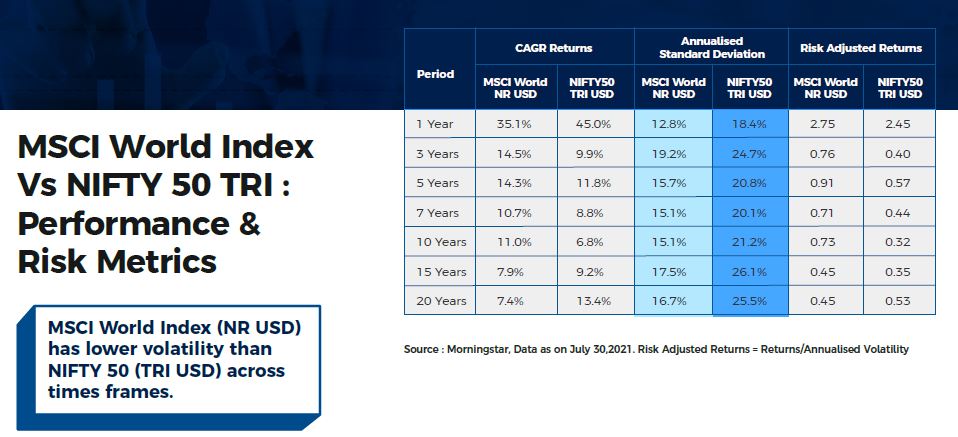

- Data indicates that the volatility ratio in MSCI World Index FOF is much lower in comparison to that of NIFTY and the addition of MSCI markets to the portfolio considerably reduces the volatility of the portfolio itself.

- Adding the depreciating Indian currency against dollars and euros, you are very much close to earning a return as good as that offered by Indian equity markets. The HDFC index FOF uses the US markets as the major component which increases the returns considerably to you, as an investor. With India being a developing nation, there will be possibilities of inflation all the time, which will add to the depreciation of the Indian Rupee against dollars and Euros.

- When you are investing in index funds, you are looking at a lower cost of investment in general. And with the HDFC index fund, this is as low as 0.5% per annum.

https://www.hdfcfund.com/our-products/hdfc-developed-world-indexes-fund-funds

Now that you have the details about the NFO on offer from HDFC, here are a few things to consider whenever you are investing in any NFO.

Things you need to know when investing in NFO

The real question is about choosing the right NFO. Here are a few things you need to take into consideration before investing in an NFO.

Fund house

The first thing you need to check out is the fund house that is offering the NFO. The fund house should have enough experience operating in mutual funds and the performance listing for the fund house should look good enough. Analyze past performances of the fund houses and check their track record before you start investing in their NFO.

NFO’s viability

You have to figure the viability of the NFO you want to invest in. Knowing the objectives of the fund will give you more information on the risk, asset allocation, liquidity, and returns you can expect. Knowing the objectives and what the fund offers will give you more control over your investments.

Past returns

Returns are what we live for, especially as investors, we are always looking for options to maximize the returns. If you want to increase your potential for returns then you need to know more about the past performances of the fund house. It is not enough that you track before investing, but a regular checkup of the investment will help you keep a better tab on your investments.

Investment cost

The New Fund Offers generally come without any entry charge or entry load. But some of these NFOs charge an exit load if the redemption happens before the end of the fund tenure. This cost has to be taken into account along with your investment cost, especially if your investment horizon is shorter than the fund tenure or lock-in period.

Risks

The biggest risk with NFOs is that you do not have a past performance record or track record to refer to. It will be difficult to gauge the performance of a fund with no metrics or asset allocation details.

Match up your goals

You have to find the lock-in period of the fund you are interested in and see if it matches up with your investment plan. If you are setting your goal at three years but the fund has a longer lock-in period, then you may have to bear exit load which can affect your returns.

NFOs provide you with the perfect window to invest in a scheme or avenue, which you have never explored before at a lower expense. It is a lucrative offer and yet it would be prudent to check the risk profile, asset allocation plan, fund manager performance, objective of the investment, etc. before you invest your hard-earned money.